Tuesday, March 31, 2009

Tuesday, March 31, After Market Close

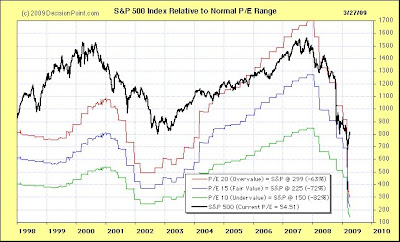

Using a 15 Fair Value P/E Ratio, Then the S&P Should be Valued at 225

Can underlying earnings in the coming year be “ramped” by the trillions of dollars being rammed into the economy? Well, anything is possible, but the earnings need to more than double across the board in the coming twelve months for the market to merely hold its ground.

Tuesday, March 31 Pre-Market Close Update

Monday, March 30, 2009

Monday, March 30, After-Market Close

March 30, Tuesday Afternoon Update 2:30 PM EST

Sunday, March 29, 2009

Monday, March 30 Pre-Market Open Comments

Saturday, March 28, 2009

The nine most terrifying words 'I'm from the government and I'm here to help"

Friday, March 27, 2009

March 27, Friday After Market Close

Thursday, March 26, 2009

Is a Major US Dollar Devaluation Imminent?

This message was just received by a trusted colleague. This summer could be very bloody, in terms of global retribution against the United States, its debt peddlers. The gloves could finally come off. The person has global connections, decades of gold and banker experience, connections with the Euro Central Bank, numerous commercial contacts in Russia, China, and Arab world, and lives with several feet in several ponds, fluent in a few key languages. He is involved in many meetings of international importance, and lately has had the advantage of being involved with both bilateral barter arrangements created by Russia (with China, with Germany). He has a strong reliability record, with advanced notice often provided in a valuable manner. Here is a quote from this morning, which was in response to some queries about continued US Treasury Bond support, recently difficulty with UK Gilt bond auctions, and general monetary debauchery by major nations like US, UK, and Switzerland.

He wrote: “However, come the end of May/June/July 2009, the United States will be put through the meat grinder once and for all. You have no idea how pissed off the creditor nations are with the unmitigated arrogance and delusional bulxxhit coming out of Washington DC / Wall Street. I have never heard people be so furious and vocal on how the US needs to be dealt with from here on forward, as demonstrated during an early morning conference call we had with Europeans, including Russians and Asians. (The emphasis is all his) All on the call are heavy-duty decision makers.” A time of reckoning comes for the US, and my opinion is that what lies directly ahead is a dark place with more economic hardship and far less liberty. Be prepared with ownership of gold & silver bullion, bars, and coins. If not, a likely outcome is more destruction of personal finances, savings, and pension holdings, along with job cuts.

March 26, Thursday After Market Close

Wednesday, March 25, 2009

March 25, Wednesday Morning Pre-Market Open Update

Can the Treasury's Ponzi Scheme Lift the Stock Market

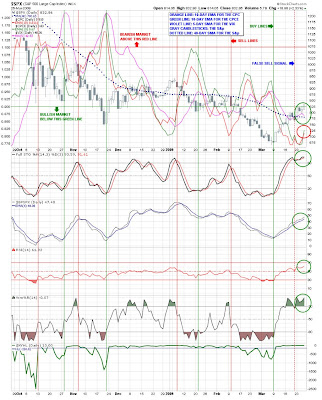

Both rallies and many others since then were nothing more than Bull-traps. Stunning one-day rallies of 500-points or more in the Dow Industrials tend to be the signature of bear market rallies, in which the PPT (federal government Plunge Protection Team) engineers vicious short squeezes. Typically, it’s an ominous sign when a powerful 500-point+ rally simply stalls out the next day, then fizzles-out, and begins to turn lower. It means the retail investor hasn’t been duped by Wall Street pros, - who are anxious to book a quick profit.

Tuesday, March 24, 2009

Tuesday After Market Close, March 24

Tuesday, March 24 - Pre-Market Open Commentary

Yesterday surprised most everyone. The market was strong with the Dow rallying 6.84% and the S&P rallying 7.8%. It was one of the biggest all time advances in stock history. The advance was powerful with about half the rally coming from short traders covering their positions.

The Asian markets are up between 1% an 3.5% this morning, but the European market markets are more timid with a range between -1% to +0.5%. The Dow and S&P futures this morning are are showing a little less than 1% loss at the open.

The market is extremely overbought short-term using both 15-min, 30-min, and daily stochoastics. Though the shorter term indicators say the market should decline today, there might be some upside rally left for a day or two, but it is nearing a top. I expect the market to begin a leg down this week or early next week if for no other reason than a correction is badly needed. I anticipate any upside action today to be relatively minor if it occurs.

Monday, March 23, 2009

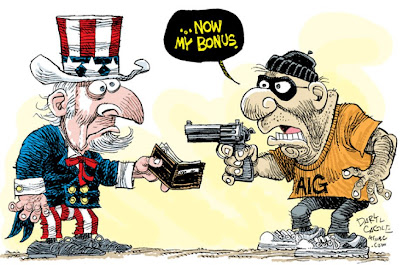

Our Ruthless Banking Elite and Timmy's Plan

In my prior post yesterday, I explained how the “Troubled Loan Program” portion of Turbo Timmy's plan is a scam. It’s a thinly disguised bank bailout at the greatest possible potential future cost to the taxpayers. Encouraging private investors to buy up the bank's troubled loans using 33:1 leveraged ratios with this program means the system will be gamed. And doing it this way means there is no need to go through Congress for a bailout, which is yet another end-around our constitution.

Then it occured to me, what if the banks themselves do the gaming. They could use surrogate companies, or bribes to friendly hege funds, or other types of strawmen to buy up their "troubled loans" at high prices. If these "troubled loan" purchases later showed no chance of making a profit, the strawmen would default on their non-recourse government loans used to make the purchase leaving the taxpayers to completely foot the bill. As a matter of fact, the price paid for the troubled loans, though no doubt they will be above maket value, will be of secondary importance to getting the toxic loans off the bank's books and into taxpayers hands.

Heck, with the 33:1 leverage offered by Geithner's plan, all they lose is the 3% down payment, but the price the buyers pay for this toxic garbage might be 50% above market. And the high prices paid by the strawmen will have plausible deniability as each troubled loan portfolio will have different risk parameters. Valuations opinions will vary widely given the existing uncertainty in the real estate market.

Never... and I mean never underestimate the ruthlessness of the American banking elite. And this is more true now than ever as they literally fight for their survival. They have bankrupted countries for profits and celebrated in some cases. This is about their survival and I look forward to documenting some of the their most popular international ruses at a later date.

Also, please don't confuse your local banker with this group, whom I know many and are generally a great bunch of guys. Most have no clue about our banking elite's shenanigans until I enlighten them. I'm talking about the big bank executives who run America's financial system.

I will leave you with a few quotes from famous people as food for thought:

Monday, March 23 After Market Close Comments

The March Housing Report and a Look at Our Real Estate Problem

RealtyTrac reported foreclosure-related filings on 2.3 million U.S. properties in 2008, an 87 percent jump from the year before, with 861,664 homes making it through the entire process to become REOs. As many of these homes were still in the process of foreclosure, or delayed foreclosure due to moratoriums on foreclosure activity by some lending institutions, it is likely the total number of actual foreclosures from the 2008 filings might reach upward to 1.5 million to 2 million homes.

The biggest problem associated with these foreclosures is that 75%± of all the properties foreclosed upon (REO) since this crisis began are still owned by the banks. Banks have been forced to bid on their own properties at the foreclosure auctions in the amount of their loan principal to prevent further deleveraging. When these foreclosures hit the market, the price of real estate will further plummet.

As of January 2009, the total FDIC insured REOs new home sales was 309,000 units (seasonally adjusted to an annual rate), and 4,912,000 for used homes; or 5,221,000 total annual home sales both new and used. The total number of homes with foreclosure filings since the third quarter 2007 was 3,900,000 dwellings. Of these, it is estimated 3 million units have or will become REO's. About 75% of all foreclosed properties since the financial crisis began in the third quarter 2007 are still held by banks and lending institutions as REO's, which is about 1.5 million dwellings. This number will likely grow to 3 million REOs owned by lending institutions in 2009. This estimate may be conservative as more homeowners lose their jobs or walk away from their underwater mortgages.

The 11-month inventory of homes in January was about 4,800,000 million homes. If the 3 million REOs anticipated for 2009 and prior years are placed on the market, the total home sales inventory would rise to about an 18-month supply. Or based on the newest numbers of unsold inventory at 9.7 months, it would equal a 16.7 month supply of home listings.

These homes will eventually hit the market, unless they are demolished, which has been given serious consideration as a solution by several economists. At what price would a home sell if all of these homes were listed for sale within two years? As ridiculous as it might sound, assuming a stable inflation rate, it is entirely conceivable home prices would fall to early 1990 prices whereby a home currently priced at $400,000 that was $600,000 a couple of years ago might have to sell for $200,000 or less; and a home currently priced at $200,000 might sell at $125,000.

This is the dire situation facing the real estate industry, the banking industry, and our economy. And I don't believe Turbo Tim's new plan is able to solve this problem. Though the federal government will provide guarantees, placing a large inventory of REOs into a declining real estate market is not economically feasible; and in fact would be a foolish thing to do.

Given that REOs will not let up until at least 2011, the private investor's Geithner hopes to purchase these homes will have a holding time of 5 years to sell; otherwise, a quick introduction of these homes into the real estate sales market will create a glut, which will cause home prices to plummet further. If private investors held onto these homes for an average of 3 years before selling them to maintain some semblance of market stability; using an annual acceptable return of say 25% (though 30% is more realistic), then home prices would need to be discounted by about 95% for the three years holding time if purchased at an unleveraged price. Using 5:1 leverage, or a 20% down payment as Geithner's plan proposes, the home purchases would require an instant 20%± discount to the price paid by private investors. And this does not include the costs associated with property management, upkeep, property taxes and other carrying costs. The point is, there are all kinds of problems with Geithner's plan, which the market will soon figure out.

Monday, March 23, Pre-Market Open Comments

The markets are euphoric with Turbo Tim's plan. At this time, Dow futures are up 146 and the S&P 16. Asian markets are up between 2% and 5%, and the European markets are up 1% to 2.5%.

There should be some good up volume today as bulls finally have something to cheer about. The market is oversold short-term coming out of Friday, so this should be an up day most all the way. We could see a couple consecutive rally days here, but intermediate term, the market is over-bought and the overall outlook for this week is down.

I will post if there are any significant developments during the day.

11:45 AM EST Update:

The S&P is hovering right at 800. If we close above here today, then we might be off to the races. The next stops up are 830; then 875. Might be time to go long.

I'll have to do more market anlaysis after close to see if a continuing rally is viable. From my perspective, I still think the market will decline this week before continuing a rally (if it does). A bigger correction is needed than the two down days last week, but stranger things have happened.

Turbo Tim Geithner to the rescue!!!! NOT!

For those who don’t want to read this entire post, the following three paragraphs sum up my opinion of Turbo Tax Tim’s plan.

The “Toxic Bad Debt Program” is okay, but it won’t set the world on fire. As a professional real estate consultant, let me assure there are too many problems in the real estate industry that are unsolvable given our current paradigm. The only way to make this portion of the plan work is to give the private sector an assurance real estate prices will go up in the future - - and the only way this can happen is by future mass inflation. If this portion of the plan works, it will be the market voting that mass inflation is imminent.

As much as I hate to say it, the “Troubled Loan Program” portion of the program is entirely a scam. It just plain stinks all over itself. It’s a thinly disguised bank bailout - - another one - - at the greatest possible potential future cost to the taxpayers. Tim Geithner is scamming the system for his banking cronies. With up to 33:1 leverage ratios offered by this program, it will be gamed. The prices paid to banks for their troubled loans will be set by the most unethical of unethical investors gaming the system. And we taxpayers will be obligated to pay top dollar as determined by these gamers when real estate values go south.

What Geithner is saying is the banks are willing to assume the bad debts already on the books, but they don’t want any responsibility for future bad debts coming down the line. Really, it’s that simple. They want to shift the responsibility and risk to the taxpayers.

The Toxic Bad Debt Program:

To target the toxic debt held by the banks, the government will create several investment funds with the Treasury, who will co-invest by contributing $1 for every $1 of private sector money invested. At this time, the plan does not specify how the profits and losses from any investment will be divided between the private investors and the taxpayers.

If one subscribes to free market intervention, then what is there not to like? It could take a lot of toxic assets off the bank books to stabilize them. But, the only way to get the private sector to invest is if they are reasonably assured real estate prices will go up. Given the current economic paradigm, there are too many problems in the real estate industry that are unsolvable. Thus, investors must be assured of future MASS INFLATION to make this portion of the plan to work. But then again, maybe I give the hedge funds and private equity firms too much credit.

Yes, there is a way to solve this problem, but it doesn’t involve continuous feeding of the big derivative black hole. The total value of home all mortgages in the US is about $10 trillion dollars. The total amount of money committed to cleaning up this toxic mess is about $12 trillion dollars with about $5 trillion already spent (not exactly sure as it goes higher each week).

If that $5 trillion were rebated back to taxpayers with the caveat at least half of the money be used to pay off debt, the financial crisis would be solved. The banks would be recapitalized, citizens would have less debt, and life could go on its merry way. But our overlords are shortsighted and too beholden to the banking elitists. This will be the subject of some later posts.

To target troubled loans, the government will create a Disposition Finance Program (DFP) working with the FDIC to act as co-investor. The banks will “package” their troubled loans for sale. Since the loans are by definition troubled, a large portion will go to foreclosure. The DFP will contribute up to 80% of the financing with private investors putting up 20% or more; i.e., 5:1 leverage. The FDIC would guarantee against losses on bad assets the banks want to sell up to $500 billion.

However, the NY Times implies the program has even greater leverage. To provide further enticement for private investors to buy these “packages,” the DFP will provide no recourse loans back to private investors up to 85% of the value of the “package.” The remaining 15% will come from government and the private investors. The DFP would put up as much as 80% of this 15% with private investors putting up the remaining 20% of the 15%. If you crunch the numbers, private investors could be contributing as little 3% of the total purchase price of the “package.” That’s a 33:1 leverage ratio.

A lot of investors are willing to spend $3 to buy a $100 “package.” That’s super leverage. The downside is private investors can only lose their original $3, but if the “package” doubles in value down the road, they could make big money. The specifics on how the profits would be divvied up are not yet available.

The problem is, with this type of leverage, the system can be gamed. As the Market Ticker explains:

Quote - - Let's say I'm "Frobozz Bank" and have $100 billion of this trash (a lot!) on my balance sheet. Its mostly performing (for now) on a cash-flow basis, but I know what the deterioration in on-time payment flow looks like, and as a consequence I know in advance that eventually this paper is going to be worth much less than my "internal" marks (that I'm reporting every quarter on Level 3.)

Aha! Now if I can be the "private party" I can overpay on purpose, capping my losses at 5% of whatever I "buy" from myself! I am thus able to transfer the other 95% of the risk onto the taxpayer and I escape with a 5% penalty off the purchase price!

That, if it happens, is an enormous scam and Treasury and the FDIC must absolutely guarantee that it not occur. If it does, we the taxpayers are going to be violated to an insane degree while the true "risk money" (and there's a lot of it out there) won't go anywhere near this program, because they, being unwilling to overpay, will simply lose the bidding contests.

So in order to prevent intentional overpayment you must as a matter of policy (and even law) enforce strict separation of the funds that are doing the buying from anyone that has an interest in the sellers, and make clear that if you catch anyone cheating extremely severe sanctions - like 100 years with Bubba - will be the consequence.

If you do not the process will get gamed and the taxpayers will lose. --End Quote

What this means is if private investors do in fact overpay for these “packages,” which they will because of high leverage, it will obligate taxpayers to pay money over and above what the assets are worth down the road if these “packages” go more than 3% south in value.

To put it mildly, this plan absolutely stinks! It’s a thinly disguised bank bailout - - another one - - at the greatest possible potential future cost to the taxpayers. High leverage helped get us into this mess, now they want to mess up the mess.

How much this plan will cost taxpayers will depend on the most unethical of the private investors. The more unethical the investor, the higher they will pay for the “packages” to game the system. If real estate prices head south; there’s no question taxpayers will pay far more for these troubled loans than they’re worth. It’s a profitable no-lose deal for the banks. They will get top dollar for their crap and once these troubled loans are off their books, they’re gone. They don’t have to worry about them again. The banking gods will be laughing all the way to the bank.

Saturday, March 21, 2009

History Never Exactly Repeats, But It Rhymes a Lot

Friday, March 20, 2009

Friday, March 20 After Market Close Commentary

Friday, March 20 Pre-Close Comments

What puzzles me is the lack of volume in today's trading. I was expecting a shootout, but there's been none so far. Unless they're saving their ammo for the last hour. Will have to wait and see.

While I was writing it looks like the bulls are making a move on good volume. But they have a lot of ground to cover to get back in the game.

New Update:

As of 3:20 PM EST, It looks like the bulls have no real fight in them. I speculate the bears are allowing the bulls a mild rally to reset the 15-minute and 30-minute stochastics, which are heavily oversold. Then about 15 minutes before close, the bears will make a final push to take the market down a notch so short term stochastics are set for further decline going into Monday. This pattern appears often. The question is, can the bears take the market down before close.

The bulls often rally between 3:40 and 3:45 EST before close each day before the bears jump in.

Thursday, March 19, 2009

Friday, March 20 Pre-Market Open Commentary

This does not negate the fact the daily full stochastics is at a top and appears to be ready to indicate a sell signal, the S&P and the Dow both hit their 40-day simple moving average, and the relative strength index hit 65. All of these indicators give indications of an imminent market turn-around.

This does mean the data is not as supportive of a market turn-around right now as it was right after close on Thursday. That being said, I am more inclined to wait for more confirmation from the CBOE index and daily stochastics before I enter short.

It is possible we could have some more upside ahead before the bulls run off the proverbial cliff again. I will also be watching the Transports, the Small/Mid-caps along with the SOX (the semi-conducted index) for early directional indicators/ signals.

The power of greed and fear drive the market. There are four to five times as many bullish investors in the stock market as there are investors shorting the market. Investors want to own stocks (take the long-side), so the propensity for bullishness is almost always stronger. The market also drops far faster then it goes up due to liquidity needs and buyers fear, which can feed on itself very quickly.

So prepare for a rollercoaster ride during the next several days as the battle ensues. When in doubt, cash is king and please trade cautiously and be quick to protect your profits. ALWAYS PROTECT YOUR CAPITAL BY USING STOPS if the trade goes against you.

Only last week on 60-Minutes Bernanke said "things are getting better and the recession would end this year." The truth is, and this cannot be overstated enough - - THE FEDS ARE IN A PANIC! They are rolling the dice!

According to some numbers to be officially released Friday (later today), the CBO will issue a special report saying our deficit for the current fiscal year will be $3.7 trillion instead of the previously reported $2.7 trillion. But let’s work with the $2.7 trillion number. This deficit will have to be financed by selling debt. As of January 2009, we had about a $10 trillion national deficit, of which, about $3 trillion will require refinancing this year, or need to be rolled over. Adding to this the current year deficit of $2.7 trillion, our country will need to finance a total of $5.7 trillion dollars this year.

The US dollar is the world reserve currency. As of 2008, there was only $2.7 trillion in American currency reserves in all other countries in the world available to finance our debt. In other words, the world can no longer finance our debt, there’s not enough money available. This is the real reason for the NUCLEAR OPTION. And if we continue to run up more deficits to pay our bills, we will have to monetize more debt. It becomes a self-perpetuating feedback loop.

The Federal Reserve asked the Treasury permission to sell debt about six months ago before seriously inflating their balance sheet. They are not allowed to do this by charter and never did. They wanted to sell debt as a mechanism to mop up excess money in circulation once the economy turned around. Without the ability to mop up excess money, they have opened up the inflationary "Pandora Box!" They will not be able to get the money back out of circulation.

In the short term, on the plus side, the NUCLEAR OPTION will keep T-bond and mortgage rates down. But on the negative side, it will cause inflation and hammer corporate and municipal bonds, which are needed for growth.

If the gamble doesn’t work, instead of having a depression lasting a few years, which is needed to cleanse the market and return us to economic vitality; we will have an "inflationary depression." Yes, there is such a thing and it will take no less than a generation to come out of it. Experts say no country in the world has ever successfully monetized massive amounts of debt - - ever!

Thusday, March 19 - After Market Close

Thursday, March 19 Afternoon Update

The new illegal immigration amnesty bill being pushed by Obama and the Democratic congress has a lot to not like. I don't know about you, but I think it's an outrage.

Lou Dobbs reports the new bill will allow all illegals to become legal within one day of filing an application, even before a background check has been made. Gang members are included by merely saying they will no longer be in gangs. Taxpayers will pay for all illegal immigration attorney bills, new visas can be renewed indefinately, we will use taxpayer money to pay Mexicans to stay in Mexico, illegal immigrants will not have to pay any back taxes, they will quality for the earned income tax credit, there's no provisions for border security, only 200 miles of the 800 mile border fence will be constructed, and all illegals will all get in-state tuition benefits currently denied to American residents. Simply amazing!

Market Update:

There's no real changes in the trend change indicators with the exception of the VIX volatility index, which is decreasing its downward slope slightly and might start going horizontal or spike up with a couple of down market days. The RSI (relative strength indicator) just hit 65±, which has coincided with rally highs and presented good selling opportunities each of the five times it hit this number in the past year.

Also, both the Dow and the S&P just hit their 40-day simple moving average (SMA) yesterday, which has typically resulted in a market top the past couple years. Using recent history as our guide, we should at best expect a period of consolidation at these price levels, or a market decline from here. But the trend is down and the trend is your friend.

Thrusday, March 19 Morning Commentary

The market is heavily overbought, it is too bullish, and daily stochastics point to a one to two week market decline to begin within the next few days. With options expiration on Friday, it is likely the bulls will try to keep the stock prices high to squeeze the short sellers. However, like yesterday, I anticipate any rallies from here to meet with heavy selling, which will keep stock prices roughly where they are at right now.

Come Monday, I anticipate a moderate market decline to begin to take the Dow do about 7,000 and the S&P to about 720 to 740. Hopefully the market will go lower to test recent lows and create a solid base for a one to two month rally. But I do not think this will happen.

Wednesday, March 18, 2009

WEDNESDAY, MARCH 18 ANALYSIS

Tuesday, March 17: CBOE 5-Day MA Graph

The above shows the 5-day moving averages for the CPC (green line), the CPCE (purple line), and the VIX (violet line) at market close. The S&P 500 is in gray.

The above shows the 5-day moving averages for the CPC (green line), the CPCE (purple line), and the VIX (violet line) at market close. The S&P 500 is in gray.I was previously using the "simple moving aveage" for the CPC and the CPCE. After further research, I discovered the "exponential moving average" (EMA) will provide better results. I have adjusted my charts using the EMA. The VIX in the graphs will continue to use the "simple moving average" (MA).

I view the 5-day MA chart more as a predictor of trend change with the 10-day MA providing confirmation. So far, we have no firm confirmation from the 10-day MA, so caution is suggested.

After Tuesday's rally, I expect some follow-through into Wednesday, but the daily stochastics are approaching a top, so we should see at least a corrective decline soon. Once again, I expect the market to rise into Friday's option expiration. But the markets will likely be very volatile before options expiration as the big players squeeze the overleveraged option speculators.

At the present, I am on the lookout for opportunties to sell into rallies on Wednesday. I will have to find an entry point into the daily channels that will offer a small profit if the market later turns around on me. If the market closes above 7,495 on the DOW for a day or two, I may have to rethink shorting this market.

I will be adding analysis of other trend indicators in coming days including the $BPSPX as a measure of the S&P bullish percent index, and the NYSE Oscillator (NYMO) as a predictor of short term bottoms and tops.

Good luck and good trading!

Tuesday, March 17: CBOE 10-Day MA Graph

Tuesday, March 17, 2009

Tuesday After Market Close, March 17

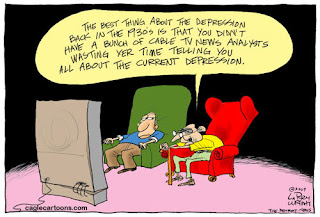

The above graph shows the DJIA during the Great Depression, when it staged at least five high percentage compact rallies, none of which ended the nightmare. With regards to today's stock market, without a retest of the the bottom, the market will likely follow this trend and continue down, down, down.

The above graph shows the DJIA during the Great Depression, when it staged at least five high percentage compact rallies, none of which ended the nightmare. With regards to today's stock market, without a retest of the the bottom, the market will likely follow this trend and continue down, down, down.Frank Barbera's Market Analysis:

Using the CPC and the CPCE, the market is bullish in total aggregate put-call volume. Frank's analysis relies on the total numbers of postions, rather than volume of put calls. Since the put-call volume is bullish, but the number of positions are bearish, and the total number of small positions should exceed the total number of big investors, I think it would follow the the small players/investors are bearish and the big money is bullish. I will have to start looking at and analyzing the "AAII Sentiment Survey" each week.

Frank goes on to say if the market continues to rally on here going above 7,450 for the DOW and 780 for the S&P - - without forming a base, then sentiment levels will change quickly to the bullish camp, which will short circuit the rally leaving a "failed bear market rally." Thus, the rally could only last a few more weeks at most; then yield to a renewed bear market decline. So, a short term bullish outcome is bearish.

Frank says, "Conversely, if prices halt the advance at these levels and begin to decline again in the near term, this could then set up the potential for what would ultimately become a much larger and more sustained stock market advance, one which could last many months. Thus, the ‘reversed-polarity’ and the ‘upside-down’ condition where a decline from here could actually be good news. It is of course ironic, as so many perceive the stock market rally as the first tangible sign of hope. For most, simple logic would argue that still higher prices would suggest that things are going to get better. Perversely, this is not likely to be the case."

Frank makes the case we need a retest of the lows before the market can stage a multi-month advance. He says, "Without that, the odds are high that the current rally will end up looking very much like one of the five or six stock market rally attempts seen during the Great Depression, where prices rallied sharply, but could never sustain the advance. As a result, we are in a paradoxical environment, where for stock prices to truly begin a sustained advance, and truly indicate a real improvement ahead, prices need to go DOWN FIRST. DOWN is GOOD in the current climate."

I find myself agreeing with Frank's analysis. We are at a critical fulcrum point. I now sumise the market will squeeze the shorts into options expiry on Friday, March 20. The market will have to go down too far to squeeze the longs in the remaining time left; i.e., three days. What happens after options expiry next week, whether the market continues to rise, or falls to form a base, could very well determine the health of the stock market for many months to come.

I'm having some friends and family over for Saint Patty's day dinner. I will post the CBOE graphs late this evening.

Tuesday Morning Analsyis, March 17

I generally never make any trades before 10:30 AM Eastern Time and often wait until 11:15. I like to see how morning trading and daily trend channels develop before entering the market.

UPDATE: 10:30 AM ET

The slope on the CPC just went south down again; i.e., continued going down and is now at 0.818; though the CPCE is still in a spike up position. This warrants caution regarding a trend reversal. Using SPY, the horizontal support line is at 75.50 with resistance at 76.35.

UPDATE: 1:15 PM ET

Some pretty powerful moves by the bulls this late morning. So far its a low volume day with the bulls pretty much in complete control. The bears will look to make a stand around 2:00 ET, but it might be game over for the day by then. Though I am a shorting trader, when the market is looking this strong, I stay out of its way. So far, it is one of those days the bulls won't be denied. Daily and 15-min stochastics are topping, but the 30-min suggests we won't have a meaningful decline until the end of the day, if any.

An analyst from one of my subscription services says the market should retrace last week's market lows by options expiry on Friday, March 20... that's three days away. Personally, I can't see that. The market would almost have to go straight down from here for the next three days to make that happen.

With so few traders/investors in the market, the market's ups and downs are controlled by the hedge funds. The problem is, the market is too bullish for the hedge funds to take it much higher. If the market doesn't start to get bearish soon, the hedge funds will truncate any rally. Look at 7,449 on the DOW for resistance.

Therein lies the belief the market needs to go down from here to dispel the general bullish trader/investor sentiment. This is why I follow the CPC and he CPCE, which gauges investor sentiments and more accurately marks turn-arounds given current market conditions.