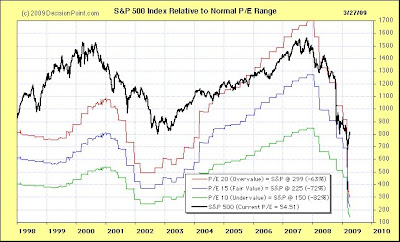

Here's a graph from an article by Brian Bloom.

For the quarter ending December 31, 2008, we had the first quarter in American history having negative earning per share for the S&P. Even after taking out the financials, the S&P earmings per share were still neative by over $2 per share.

Based on rolling 12 months historical earnings – adjusted for Generally Accepted Accounting Principles – the Price/Earnings ratio of the Standard and Poor 500 Industrial Index in the USA was 54.51 as at March 27th 2009.

In simple English, if the S&P Index was to adjust to an historically overpriced level of 20X P/E ratios (the level of red line), it would need to fall by 63% from its current level.

Can underlying earnings in the coming year be “ramped” by the trillions of dollars being rammed into the economy? Well, anything is possible, but the earnings need to more than double across the board in the coming twelve months for the market to merely hold its ground.

When the current market bounce is exhausted, the Primary Bear Trend is more likely than not to resume with a vengeance – given that it will be patently obvious to a blind man that the authorities will have thrown everything but the kitchen sink at the economic downturn; and failed to arrest it.

No comments:

Post a Comment