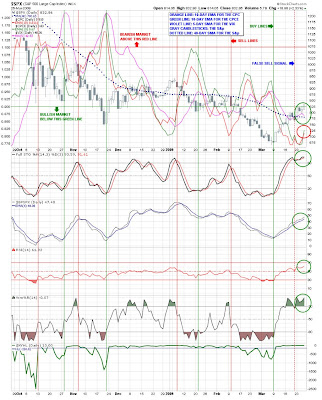

The only change in the indicators from yesterday to today is the VIX spiked down into a bullish position. The CPC and CPCE spiked up hard saying market sentiment is strongly supporting a trend turn-around.

Tuesday, March 31 marks the end of the quarter for most hedge funds, banks and other financial institutions. They have a vested interest in keeping stock prices high until then as financial executive bonuses are often based on stock price closings at quarter end. From the market market action, it appears they will keep the S&P above 800 until Wednesday of next week and maybe even take it higher in the interim.

Unless there is some major bad news event in the mean time, I expect normal market forces to resume after March 31. As most of the stock market indicators are in an extremely over-bought condition, a major drop in stock prices could come Wednesday next week when the new quarter begins.

The 15-min Stochastics says stock prices should rise in the morning after market open with 30-min Stochastics indicating prices should drop in the afternoon.

No comments:

Post a Comment