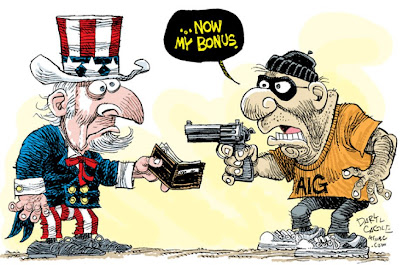

Its amazing our politicians are spending all of this time making villans out of AIG executives for $150 million in bonuses when they're stealing $trillions from taxpayers. Don't get me wrong, I don't like the idea of paying bonuses with taxpayer money, but the whole charade strikes me as an attempt by our leaders to cast blame away from themselves.

Market Commentary:

The market was due to drop yesterday with the bears appearing to save their ammunition for an afternoon decline. After the Fed announcement, it was all out tug-of-war between the bulls and bears with volume moving to extremely high levels. I was impressed the bears kept the Dow from closing above 7,449 or the S&P above 800.

The market is heavily overbought, it is too bullish, and daily stochastics point to a one to two week market decline to begin within the next few days. With options expiration on Friday, it is likely the bulls will try to keep the stock prices high to squeeze the short sellers. However, like yesterday, I anticipate any rallies from here to meet with heavy selling, which will keep stock prices roughly where they are at right now.

Come Monday, I anticipate a moderate market decline to begin to take the Dow do about 7,000 and the S&P to about 720 to 740. Hopefully the market will go lower to test recent lows and create a solid base for a one to two month rally. But I do not think this will happen.

The market is heavily overbought, it is too bullish, and daily stochastics point to a one to two week market decline to begin within the next few days. With options expiration on Friday, it is likely the bulls will try to keep the stock prices high to squeeze the short sellers. However, like yesterday, I anticipate any rallies from here to meet with heavy selling, which will keep stock prices roughly where they are at right now.

Come Monday, I anticipate a moderate market decline to begin to take the Dow do about 7,000 and the S&P to about 720 to 740. Hopefully the market will go lower to test recent lows and create a solid base for a one to two month rally. But I do not think this will happen.

I will be looking for trend changes with the idea to short the market at Friday’s close. If the Dow and the S&P close significantly above 7,449 and 800 respectively on Thursday or Friday, I will likely await trend change signals before I go short. There is always the possibility the market could continue to rally from here, but I think this is a lower probability scenario.

I also anticipate gold will begin a one to two week rally before declining into the spring and summer doldrums. However, with the recent Fed announcement they are going to monetize $1 trillion of debt, the summer doldrums might not be so low. I think $800 an ounce will be the bottom for gold this year.

No comments:

Post a Comment